More savings for your

CAR INSURANCE

The best prices with immediate

coverage at Adriana's Insurance

At Adriana's , we offer more options for you to choose the one that best suits you. Get the insurance you need at the best price.

Enjoy the benefits of having all your needs covered with Adriana's!

Office & Services Questions

Office & Services Questions

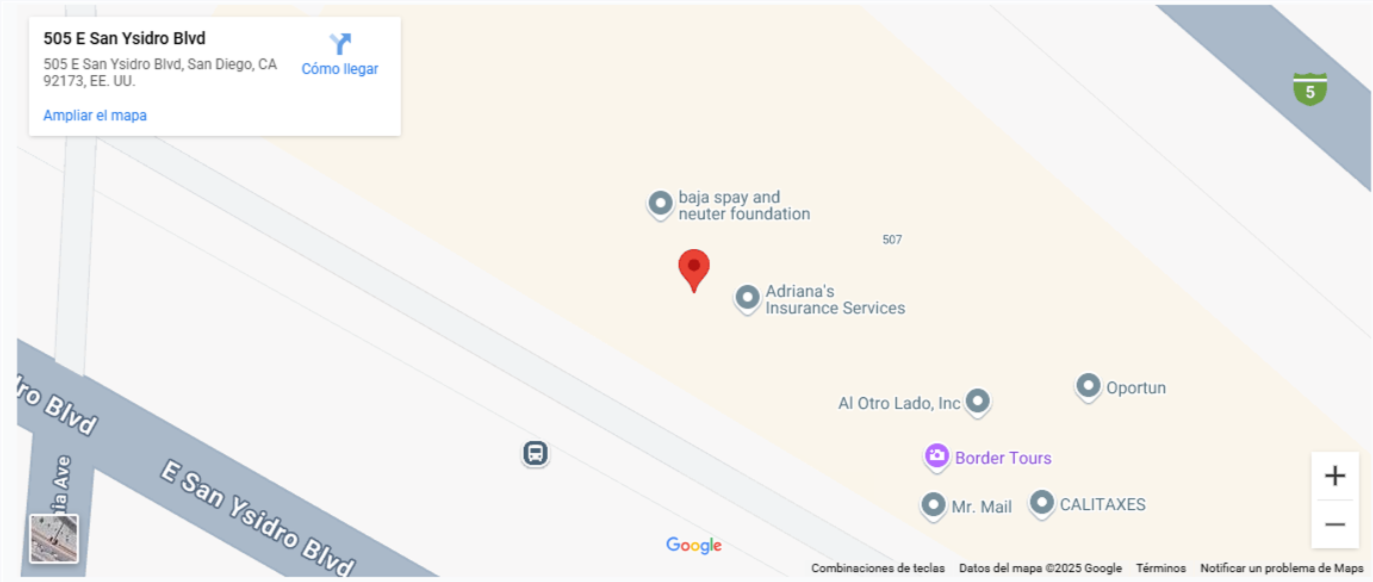

We have multiple office locations conveniently situated across different cities, making it easy to find one near you. Visit us at any of our offices to receive personalized assistance and support.

Our local offices are typically open Monday through Friday 9 AM to 7 PM and Saturday 9 AM to 5 PM. We offer extended service hours over the phone Monday through Friday 7 AM to 8 PM and Saturday and Sunday from 9 AM to 5 PM.

The documents you’ll need to bring will depend on the service you're seeking. To make your visit as quick and easy as possible, here’s a list of the documents you'll need for some of our most common services:

For New Car Insurance: You will need your vehicle registration, bill of sale or title, and a valid form of ID (such as your driver’s license).

For Registration Renewals: You can bring your current or expired registration notice or your bill of sale, as well as your proof of insurance.

For Traffic School: To register, your ticket must be paid, and you must be approved to enroll by the court. You will need your driver's license, the citation or case number, the due date, and the name of the court.

If you’re missing a document or are unsure of what to bring to your visit, just give us a call at 1-800-435-2997 and our agents will be happy to guide you.

Our office locations offer convenient on-site parking, available for the length of your visit.

We know the importance of doing business in your own language. That’s why our agents are proudly bilingual in both English and Spanish.

At Adriana’s Insurance, we specialize in providing our customers with a variety of services, like immigration form assistance, auto, home, commercial, and life insurance, traffic school, and many DMV services. Our agents can process your plate renewal, title transfer, international driver's license, and more in office, saving you time and a trip to the DMV.

You can file a claim against the other driver by contacting that person’s insurance company. You will need the other driver's full name, policy number, the date of the accident, and any other pertinent information. Additionally, you will need to provide the details of the accident and be prepared to answer specific questions about the accident. Claims # 855-277-6510

Yes, be aware that some police departments may not respond to accidents based on the severity, type of accident, or location. We recommend filing a police report immediately any time you experience an auto accident, theft, or vandalism to your property.

If you were court-ordered to complete traffic school as part of your sentence in California and you fail to comply, the Department of Motor Vehicles (DMV) will place a point on your driving record. Points on your record can cause your insurance rates to go up, sometimes by 20–40%, and you may end up paying a higher rate for the next three to five years. You can complete traffic school with Adriana’s, online or with study materials in English or Spanish at https://www.adrianasinsurance.com/traffic-school.

Adding a new vehicle to your existing insurance policy is fast and easy. Coverage for the new car can usually start as soon as the same day that you confirm the changes.

You’ll need the new car's information, especially the Vehicle Identification Number (VIN), which is usually located in a few locations on the vehicle: Many cars have the VIN printed on the driver’s side dashboard and can be seen by standing outside the vehicle and checking the area where your dashboard meets the windshield. You can also usually find the VIN printed on a sticker in the driver’s side door or door jamb or printed on the vehicle’s title or current insurance card.

Once you’ve located the VIN, simply contact your agent, confirm the policy changes, and you’ll be back on the road.

We accept both credit and debit cards, as well as cash at our office locations, so you can choose the payment method that works best for you. If you have any questions about a specific type of card or need assistance with your payment, our team is always happy to help when you stop by.